BTC Price Prediction: Analyzing Key Drivers and Investment Outlook

#BTC

- BTC is consolidating near key technical levels with potential for upward movement if support holds.

- Institutional adoption and macroeconomic factors are creating a favorable environment for Bitcoin.

- Short-term volatility may persist, but long-term fundamentals remain strong.

BTC Price Prediction

Technical Analysis: BTC Shows Consolidation Signals Near Key Levels

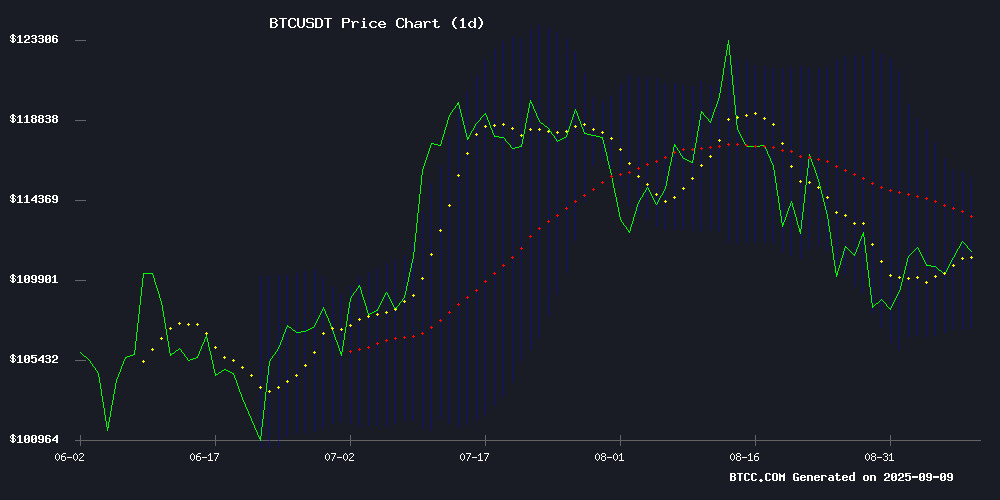

BTC is currently trading at $111,124.76, slightly below its 20-day moving average of $111,380.06, indicating potential short-term consolidation. The MACD reading of -882.71 suggests weakening momentum, though the price remains within the Bollinger Band range of $107,153.61 to $115,606.50. According to BTCC financial analyst Olivia, 'The technical setup suggests BTC is testing crucial support levels. A sustained hold above $110,000 could pave the way for another attempt at the $113,000 resistance.'

Market Sentiment: Institutional Moves and Macro Factors Drive Optimism

Positive institutional developments, including Metaplanet's $1.4 billion Bitcoin treasury expansion and Microsoft's $17.4 billion AI infrastructure deal boosting mining stocks, are fueling bullish sentiment. Fed rate cut speculation and weaker U.S. payroll data are adding macroeconomic tailwinds. BTCC financial analyst Olivia notes, 'The combination of corporate adoption and favorable macro conditions is creating a supportive environment for Bitcoin, though short-term volatility around CPI data remains a factor.'

Factors Influencing BTC's Price

Metaplanet Raises $1.4B to Expand Bitcoin Treasury Holdings

Metaplanet Inc. has finalized its international offering, raising approximately $1.4 billion to further its Bitcoin acquisition strategy. The Tokyo-listed company increased its share offering from 180 million to 385 million shares, with JPY 183.7 billion earmarked for BTC purchases and JPY 20.4 billion allocated to Bitcoin-related income generation.

The firm recently added 136 BTC to its holdings, bringing its total stash to 20,136 BTC—worth roughly $2.2 billion at current prices. This aggressive accumulation comes despite concerns about corporate overexposure to cryptocurrency volatility.

Shareholders recently approved key measures including an increase in authorized shares and provisions for perpetual preferred stock, signaling continued institutional commitment to Bitcoin as a treasury asset.

Bitcoin Price Prediction: $10K Swing Looms After $112K Breakout

Bitcoin's surge past the $112,000 resistance level has ignited speculation of a volatile $10,000 price swing. The breakout marks a pivotal technical threshold, with traders now weighing whether bullish momentum will sustain or reverse sharply.

Market sentiment remains cautiously optimistic, though dangerously high leverage ratios threaten liquidation cascades. Upside targets cluster between $118,000-$122,000, fueled by ETF inflows and expanding stablecoin liquidity. Conversely, failure to hold $112,000 could trigger a retreat to $100,000-$104,000 support levels.

The current environment reflects classic price discovery volatility. While institutional participation through ETFs provides structural support, the derivatives market's overextension creates fragility. As one trader noted: 'This is the knife's edge - the next move will shake out weak hands on either side.'

Bitcoin Mining Stocks Rally on Microsoft's $17.4B AI Infrastructure Deal

Cryptocurrency mining stocks surged Tuesday as investors bet on the sector's high-performance computing potential following Microsoft's $17.4 billion GPU procurement deal with Nebius Group. The five-year agreement to bolster AI infrastructure sent Bitfarms (BITF) up 22% and Cipher Mining (CIFR) 20% higher, with IREN, Hut 8, Riot Platforms and TeraWulf all posting mid-teens gains.

The rally occurred despite Bitcoin's 1% decline to $111,100, highlighting a growing investor focus on miners' computing infrastructure rather than pure cryptocurrency exposure. Marathon Digital (MARA) underperformed with a 4% gain, reflecting its recent pivot toward Bitcoin treasury management rather than high-performance computing.

The sector's shifting dynamics were laid bare as traditional drivers like Bitcoin's halving cycle give way to new valuation metrics centered on energy-efficient data processing capabilities. This comes as miners face mounting challenges from power cost volatility and intensifying competition for next-generation hardware.

Bitcoin Knots Captures 19% of Active Bitcoin Nodes Amidst Core Update Controversy

Bitcoin Knots, an alternative node client, now accounts for 19% of all active Bitcoin nodes, marking a notable shift in the network's client distribution. This surge in adoption coincides with the release of Bitcoin Core's version 29.1, an update aimed at improving performance and security but met with mixed reactions.

Critics within the Bitcoin community have raised concerns over policy changes related to transaction processing and network upgrades embedded in the Core update. The debate underscores broader tensions over protocol governance and the direction of Bitcoin's development.

While Bitcoin Core remains the dominant client, the growing traction of Bitcoin Knots signals a willingness among users to explore alternatives. The trend reflects a diversifying ecosystem where differing functionalities and policy preferences are gaining ground.

Bitcoin Long-Term Holders Show Resilience as Coins Age into Older Cohorts

Bitcoin's long-term holders are demonstrating remarkable resilience, with on-chain data revealing a structural shift in investor behavior rather than panic selling. Glassnode's latest analysis shows coins aging into older cohorts, painting a picture of steadfast conviction among veteran investors.

The 5-7 year holder group saw its Realized Cap decline by 43% over the past year, falling from $14.9 billion to $8.5 billion. This reduction stems not from mass exits, but from the natural progression of assets into the 7-10 year bracket—a phenomenon Glassnode terms 'upward promotion.'

Realized Cap dynamics serve as a sophisticated proxy for investor psychology. When coins graduate to older age bands without significant selling pressure, it signals deepening roots in the ecosystem. These diamond-handed investors continue holding through market cycles, effectively locking up supply.

Bitcoin Surges Past $113K Amid Fed Rate Cut Speculation

Bitcoin breached $113,000 as markets priced in potential Federal Reserve easing, marking its highest level since late August. The rally reflects growing optimism that weak U.S. jobs data could prompt a 25-50 basis point cut at the September 17 meeting.

Whale activity suggests profit-taking at these levels, with the most significant sell pressure since mid-2022. Technical analysts warn failure to hold $113K may trigger a retracement to $108K-$110K, while sustained momentum could test resistance at $114,200 and $115,000.

Arthur Hayes of BitMEX speculates about a 50 basis point cut, amplifying crypto's appeal as a risk asset. Some forecasts now target $150K-$200K by year-end, though the $113K level remains a critical battleground for bulls.

Bitcoin Price Rejected at $113k Ahead of CPI Data: JPMorgan's Analysis

Bitcoin's attempt to breach the $113k resistance level faltered during the mid-North American session, triggering a 1.1% retreat to $110,822. The pullback cascaded across altcoins, liquidating $370 million in leveraged positions—primarily long contracts—as traders braced for macroeconomic crosswinds.

Two catalysts drove the downturn: Revised Biden-era job figures revealed a staggering 1.5 million overstatement in employment growth, while markets positioned for August's CPI data. JPMorgan anticipates headline CPI at 2.9% year-over-year, with core inflation holding firm at 3.1%.

Bitcoin Holds Near $110K Amid Mixed Halving Signals and Macro Shifts

Bitcoin trades near $110,000 as weaker U.S. labor data pressures Treasury yields and the dollar, typically bullish catalysts for crypto. Yet analyst Plan C cautions against assuming a Q4 halving rally is inevitable—historical patterns show inconsistent outcomes, undermining seasonality as a standalone signal.

Technical confirmation remains pivotal. Holding $110K–$112K support, followed by a volume-backed reclaim of $117K–$118K, could ignite upward momentum. A breakdown may trigger rotation into altcoins with clearer breakout setups and asymmetric risk-reward profiles. The debate intensifies: will Bitcoin dominance drive the next leg, or is capital rotation into alternatives the strategic play?

Macro conditions improved after the latest jobs report revealed slowing hiring, rising unemployment, and negative revisions. The dollar index fell 0.7%, while Fed rate cut expectations for September climbed. "Labor weakness gives the Fed room to cut," noted one strategist. Dovish policy could stabilize BTC by easing funding costs, but traders await chart confirmation before committing to bullish positions.

Japanese Firm Convano Plans $140M Bitcoin Purchase Following Metaplanet's Lead

Tokyo-listed Convano is raising $139.2 million through straight bonds to acquire Bitcoin, mirroring Metaplanet's corporate treasury strategy. The move would more than double Convano's current holdings of 520 BTC, potentially adding 1,200 coins at current prices.

Metaplanet's 20,136 BTC reserve—the sixth-largest corporate holding globally—has become a blueprint for Japanese firms. Nexon and Remixpoint are among other Tokyo-listed companies allocating to Bitcoin, signaling Japan's emergence as a hub for institutional crypto adoption.

The bond issuance reflects growing conviction in Bitcoin's digital gold narrative. Convano's leveraged bet underscores institutional willingness to deploy capital despite market volatility, with yield-seeking strategies now extending to crypto assets.

U.S. Payroll Revision Reveals Weaker Labor Market, Sparks Rate Cut Speculation

The U.S. labor market showed significant weakness with a record downward revision of 911,000 jobs for the period ending March 2025. This adjustment, the largest in history, suggests previous Nonfarm Payrolls reports overstated employment growth—a critical input for Federal Reserve policy and institutional capital allocation.

Market expectations for aggressive Fed easing intensified following the release. Traders now price in a 50 basis point cut at next week's meeting, doubling prior forecasts. The revision implies policymakers may have acted sooner had accurate data been available.

Rate-sensitive assets exhibited classic "buy the rumor, sell the news" behavior. Gold futures briefly touched a record $3,700 before paring gains, while Bitcoin retreated 1% from its $113,000 peak. The muted reaction underscores how much easing expectations were already priced into markets.

Germany Missed Seizing 45,000 BTC Linked to Piracy Site Movie2K, Arkham Reports

Arkham Intelligence has uncovered a significant cache of 45,000 BTC, valued at $5 billion, tied to the defunct film piracy platform Movie2K. German authorities reportedly overlooked these funds during a January 2024 confiscation of nearly 50,000 BTC from the same operation.

The German government later sold its seized Bitcoin holdings for $3 billion in July 2024, a sum that has since appreciated to $5.62 billion. Arkham's blockchain analysis identified dormant wallets holding the additional BTC, untouched since November 2013.

This revelation comes after German police initially seized 49,858 BTC from Movie2K operators in early 2024, selling the assets at an average price of $57,900 per coin. The newly discovered cluster suggests authorities captured less than 60% of the piracy operation's total Bitcoin reserves.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents a compelling investment case, though with noted volatility. The price is consolidating near $111,000 with strong institutional interest and macroeconomic support. Key factors to consider:

| Factor | Details | Impact |

|---|---|---|

| Price Level | $111,124.76 | Near 20-day MA, testing support |

| Institutional Demand | Metaplanet $1.4B purchase | Bullish for long-term adoption |

| Macro Conditions | Fed rate cut speculation | Positive for risk assets |

| Technical Indicators | MACD negative but within range | Short-term consolidation likely |

BTCC financial analyst Olivia suggests, 'While short-term fluctuations are expected, the underlying institutional and macroeconomic trends support a positive long-term outlook for BTC.'